Monitoring your credit report is like a health checkup for your finances. Better yet, it’s free and easy to do. That’s because Federal Law requires each of the three nationwide credit reporting agencies to give you a free credit report, if you request it.

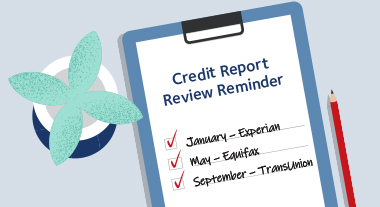

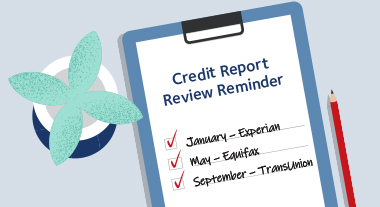

Operated jointly by the three major credit bureaus, annualcreditreport.com is the website recommended by the Federal Trade Commission (FTC) as the only authorized website for free credit reports. We recommend checking your report throughout the year so you can better spot changes or discrepancies. For example, check Equifax at the beginning of the year, TransUnion mid-year, and Experian at the end of the year.

PRO TIP: Check your credit report three times a year.

Credit reports can be a bit confusing. That’s where we come in. Here are some things to watch for and what they mean to your credit.

Accuracy

Your credit report can help you gauge your financial picture from a lender’s perspective. However, you should review the entire report for general accuracy. If you see any accounts that you didn’t open or any errors with existing accounts, you should contact the credit bureau and the reporting business to initiate the process to correct them. According to the Fair Credit Reporting Act, both parties are responsible for correcting inaccurate or incomplete information in your report.

Inquiries

Your credit report will show who has been accessing your credit report. These inquiries are categorized as “soft” or “hard.” Soft inquiries occur when someone reviews your credit, but hasn’t asked for credit. For example, when you review your credit report or a lender receives a change in your credit status in relation to a credit card account, a soft inquiry is noted. Soft inquiries do not affect your credit score.

Hard inquiries occur when a business has accessed your credit report with the intent to offer credit. For example, when you apply for a credit card or auto loan, a hard inquiry is noted. Infrequent hard inquiries don’t normally affect your credit score too much. However, frequent hard inquiries indicate an increasing desire for credit and can adversely affect your credit score. If you see any hard inquiries that you don’t recognize, it may be an indicator that someone is trying to use your credit score or is committing identity theft. In that event, report the inquiry to the appropriate credit bureau.

Late payments

Delinquent payments heavily influence your credit score. If you see that your bills have been paid 30, 60, 90 or 120 days late, that can be very damaging to your score and your future ability to get a loan. The greater the payment delinquency, the more damage to your credit score.

Timing also can be a decisive factor with late payments. For example, how long ago was the late payment? Was the late payment an exception? Have late payments been a regular occurrence? Over time, late payments will become less damaging if your recent payment history is consistently satisfactory.

Credit utilization ratios

Credit scoring also considers your debt-to-credit limit ratio, or utilization of available credit. This ratio compares your existing balances with your available credit limit. For example, $10,000 in available credit with $1,000 in balances would give you a 10% credit utilization ratio. The ratio demonstrates to lenders whether or not you are living within your means. Generally a lower ratio has a more beneficial impact on your score.

Open accounts

An excessive number of credit cards and available credit can lower your score. Lenders and credit bureaus want to see responsible spending to show that you can have the available credit, but not necessarily use it.

Collections

Accounts that have gone to collection departments or have been written off as a bad debt can stay on your credit report for up to seven years. Lenders will be more reluctant to give a loan to someone who has caused a loss.

Typically, members are aware of adverse credit experiences on their credit report and many are making efforts to pay the obligation through workout agreements or legal proceedings. It is not uncommon, though, for consumers to be unaware of low level or inactive collection activity such as a forgotten insurance deductible with an old medical bill. You can start to remedy this type of situation by contacting the creditor.

It’s also increasingly common to see a collection entry on a debt that is not yours. Should you encounter that situation, you must contact the credit bureau and have the entry removed from your report. Unfortunately, identity theft is a growing problem for consumers and makes the need for reviewing your credit report even more important.

Judgments, liens, bankruptcies

You’ll find these listings in the public records section of your credit report. These types of events are extremely damaging to your score and can stay on your credit report for up to 10 years.

Have questions?

Monitoring your credit report throughout the year can help you to catch discrepancies, identity theft, and more before it’s too late. Visit annualcreditreport.com to get started.

If you have questions about your credit report, 1st United members can make an appointment to bring it in to any 1st United branch and our friendly branch staff would be happy to walk you through it.

Share Options

Monitoring Your Credit Report

Subscribe to Our Blog

* Required

Thank you.

We appreciate your interest.

Download your free credit report review from annualcreditreport.com.

The Affordable Way to Manage Your Spending

Want low rates for purchases, cash advances and balance transfers? Our Visa Platinum card is for you!