Annual Report

We remain committed to your financial wellness

We remain committed to your financial wellness

As a not-for-profit financial cooperative, our top priority is the financial health of our members and the community. This commitment guides every decision we make— and it will never change.

As Chair of the Board of Directors, I’m continually inspired by the dedication of our employees and our volunteer Board of Directors who serve alongside me. Together, we work to ensure 1st United remains safe, sound, and positioned to deliver lasting value to our member-owners.

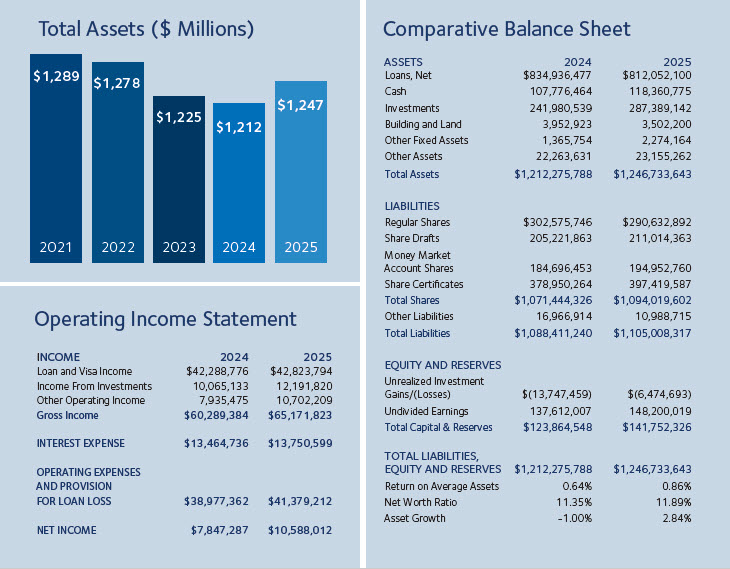

This year, we reported net income of $10.6 million and grew total assets to $1.25 billion, reflecting the continued trust of more than 63,000 members. We also remained well-capitalized with a net worth ratio of 11.89%, exceeding regulatory standards and reinforcing the strength and stability of our Credit Union.

To support our continued growth, we expanded our Supervisory Committee to seven volunteer members, enhancing oversight, accountability, and protection for our members.

On behalf of the Board, thank you to our staff for their commitment and care, and to our members for your continued trust. It’s a privilege to serve you—and to help build a stronger financial future for our community, together.

Access your accounts, move money, and make payments all within our user-friendly mobile app.