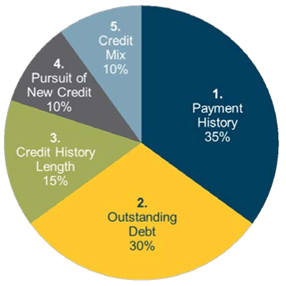

Credit 101: What Makes Up a Credit Score

Tagged as: Credit 101

Credit 101: What Makes Up a Credit Score

Checking Accounts

No monthly fee or minimum balance requirement.

Contact Us

We're here when you need us.

Today's Rates

Don't miss out on our competitive rates.

Subscribe to Our Blog

* Required

We appreciate your interest.

Want low rates for purchases, cash advances and balance transfers? Our Visa Platinum card is for you!