Skip Pay lets you skip your loan payment twice a year per eligible loan for a low, $35 processing fee for each skip. Note that you can only skip one payment per six-month period.

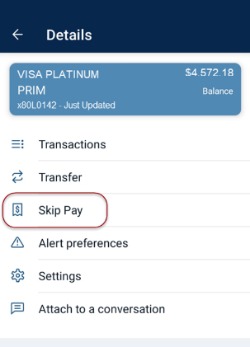

- Log in to your account and select any loan, then click the Skip Pay button from the loan menu.

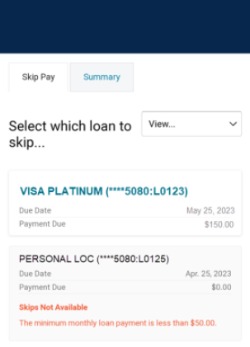

- Select the eligible loan you wish to skip a payment for that month.

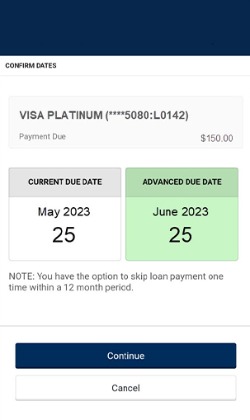

- Your Current Due Date and Advanced Due Date will display for your information. Tap Continue.

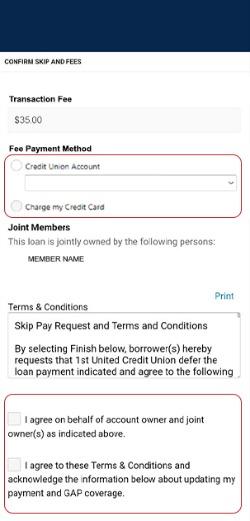

- Using the drop down, select whether you'd like to pay the $35 Skip Pay fee using one of your 1st United accounts or by credit card, and fill in the necessary information.

- Review and agree to the Terms & Conditions

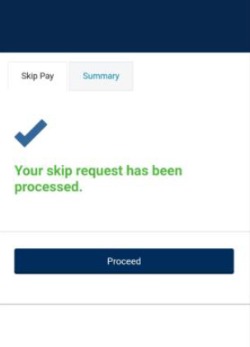

- Tap Finish. The Skip Pay process is complete!

If you are set up to make your payment through auto pay options, there may be additional steps.

If you pay your loan by cash or check, or by transferring money when the payment is due:

- Follow the steps above to Skip Pay.

- Pay your Skip Pay fee from your checking or savings account, or with a credit card.

- Do not make your payment for the month, but begin making your payment the next month.

If you pay your loan with a recurring transfer:

- Follow the steps above to Skip Pay.

- Turn off your recurring transfer for the payment period, then turn it back on for the next month.

If your payment is made through bill pay from another financial institution:

- Follow the steps above to Skip Pay.

- Turn off your bill pay at your other financial institution for the payment period, then turn it back on the next month. If we receive a payment via bill pay during your skipped payment period, we will accept the payment but, unfortunately, won’t refund the $35 fee.

Share Options

How to Skip a Loan Payment

Subscribe to Our Blog

* Required

Thank you.

We appreciate your interest.