Personal Banking 101: Managing Bills When Money is Tight

Tagged as: Banking Basics, Smart Spending

Personal Banking 101: Managing Bills When Money is Tight

Checking Accounts

No monthly fee or minimum balance requirement.

Become a Member

Join 1st United Credit Union today!

Today's Rates

Don't miss out on our competitive rates.

Subscribe to Our Blog

* Required

We appreciate your interest.

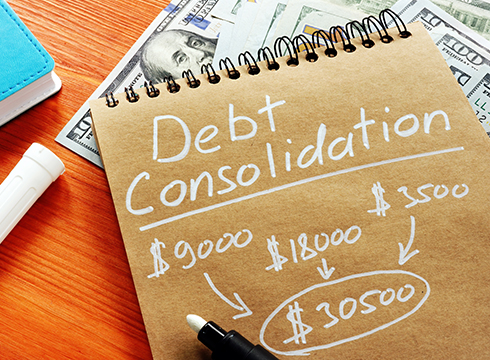

Whether you're planning your next vacation, staycation, home remodel, or simply want to consolidate debt, we have the financing for you.